Imagine that you want to get a new book, but it is sold out.

There is a very high demand for that book, but not enough copies have been released.

When the book is on the market again, it costs 10% more than before it was sold out.

The book continues to be very popular and consumers are prepared to buy this book even when it costs 10% more.

The new price sticks and the book is now being sold at the new, higher price.

This is a basic example of how the demand-pull inflation works.

Of course, the shortage of one book does not cause inflation and prices on certain items go up and down all the time. However, when this starts happening consistently across the different sectors for a prolonged period of time it means the prices in general have gone up.

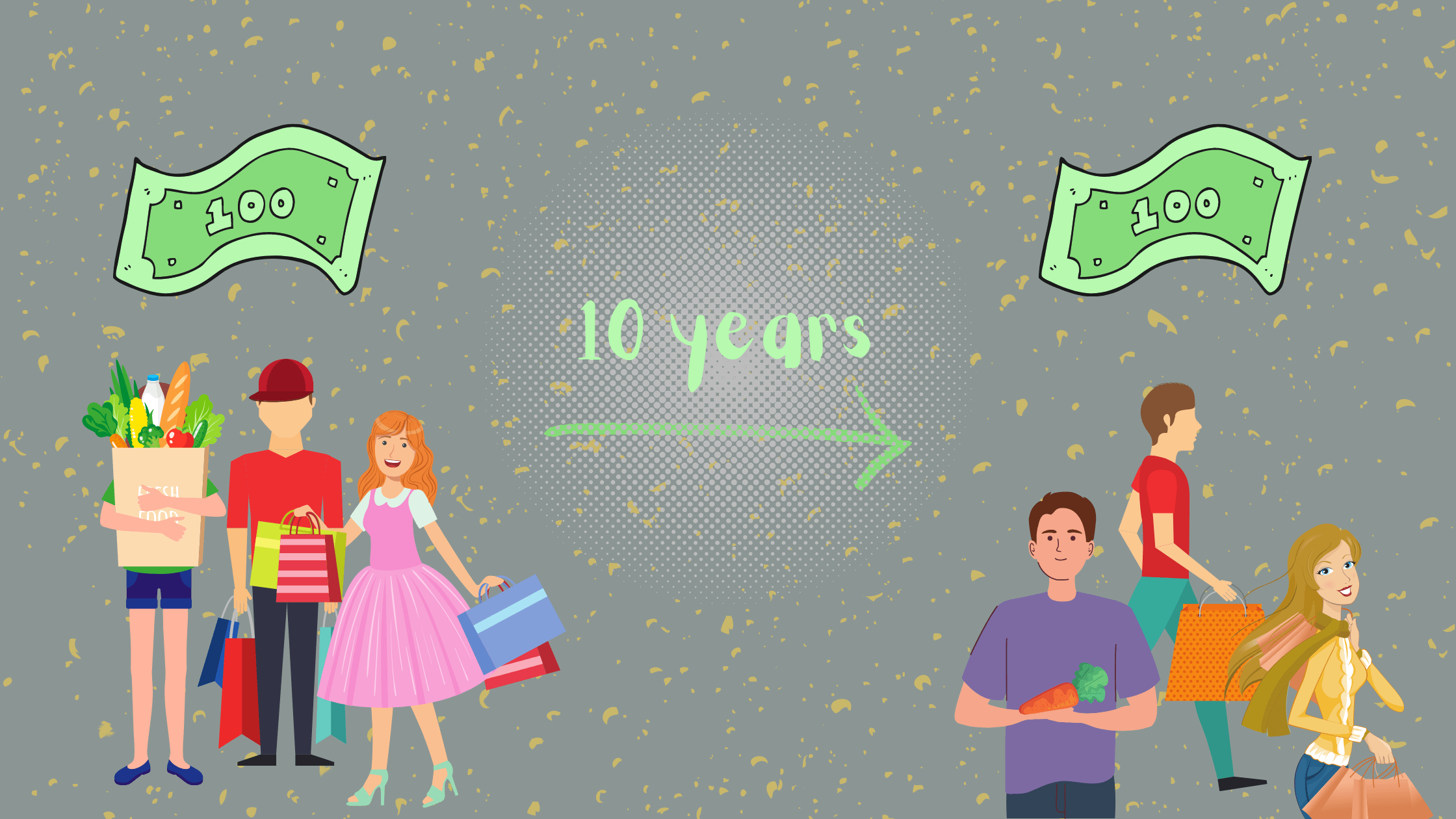

As a result, a consumer ends up paying more for the same amount of products and services.

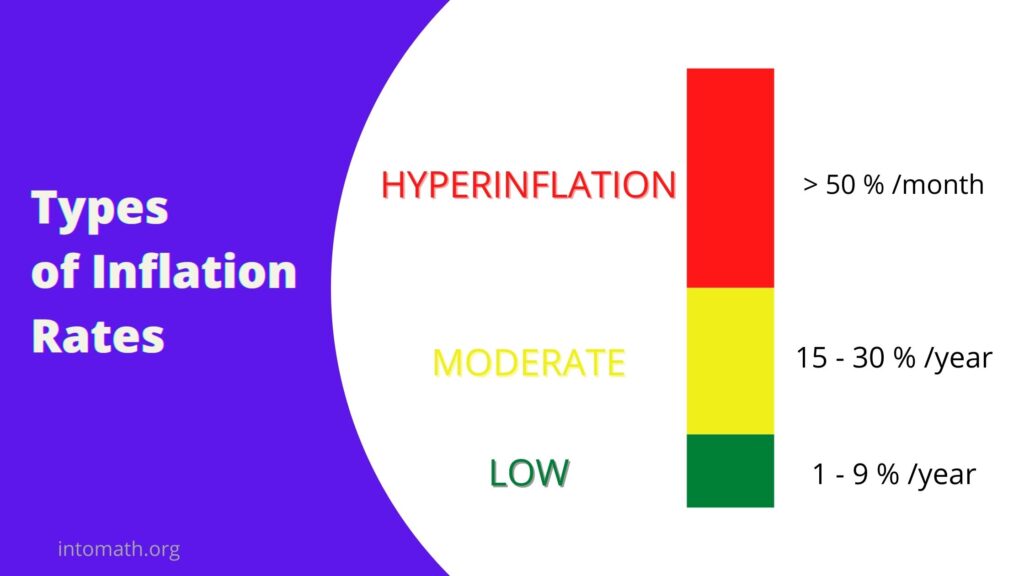

An inflation rate (in %) is how much the prices of goods or services go up on average over a certain period of time.

The annual (per year) inflation rate between 1% and 3% is considered low.

When the inflation rate hits 50% per month it becomes hyperinflation.

Think of it this way: if a sweater costs $30 today and the annual inflation rate remains steady at around 2% each year, it would take 35 years for this type of sweater to cost double the price today ($60).

If the inflation rate is 50% per month, then that same sweater will cost double in just 1.7 months!

At the same time, wages cannot usually keep up with inflation.

Thus, when the annual inflation rate is high, you may be making the same money as you did before the inflation hit, but now can afford less.

Hyperinflation is not always caused by just the imbalance between the supply and demand in products and services. Sometimes it is the result of an increase in the money supply – when the government starts printing more money. And most frequently both factors occur at the same time – increase in the money supply and increase in demand + shortages of products and services.

The money circulates in the economy all the time. People earn money, save money and spend money.

However, there are times when the government decides to print more money than there already is in circulation. This decision can be made in response to some economic or other type of crisis.

So why does printing more money cause or adds to inflation?

Imagine that the amount of money you receive as a support from the government in addition to what you are making at your work has doubled. You are inevitably going to spend more. This will drive the prices up, because there is more demand. This will also gradually devaluate the money (more and more money will have to be paid for the same thing). All of a sudden, what cost $1 will now cost $20. Therefore, $1 is no longer as valuable.

All in all, a low and predictable level of inflation means the economy is doing well.

When inflation starts rising, it causes panic, more shortages and even higher inflation.

More Financial Math from IntoMath

One thought on “Why is there inflation? Explained simply”