How to get a credit card

What is a credit card?

A credit card is a plastic card issued by a financial institution that allows you to borrow money from the bank up to a certain limit. You are required to pay the money back to the bank monthly. If you cannot pay it back, the bank will charge you interest on the amount you owe. Credit card interest rates are rather high.

You can pay with a credit card for goods and services within the allowable limit. The money does not come directly from your savings or chequing account, but is loaned to you by the bank.

There are different types of credit cards. Some offer rewards for using the card (such as money rewards or reward points that could be spent on goods and services). To get certain types of credit cards you would have to have a very good credit history – meaning you would have to have been using the card for a while paying it off on time with no penalties. Thus, it is very important to ensure that your credit history is good (that you are paying your credit card bills on time).

How to get a credit card?

The most basic credit card is the one you could get as a new user. It usually has a $500 limit and no rewards. You can get it at most of the banks without any prior credit history.

In order to get a credit card, you would need to call a financial institution of your choice or visit one of the branches. In Canada you cannot get your own credit card until you are 18. The bank will ask you for your photo ID and you will need to fill out an application form. Once you sign and submit everything, the bank will mail you the card usually within a week.

Once you get a card, you could start using it to pay for goods and services (where credit cards are accepted). You could make online purchases.

You would need to keep track of your purchases to ensure you don’t go over the allowable limit (your card will be denied if you do), as well as pay your balance back to the bank monthly.

How does credit card work?

Say, you have built up a little bit of credit history, have always been paying your credit cards bills on time and now your credit card limit is $5000 + you now get some cash back rewards from your financial institution for using the card to pay for certain goods and services (around 1% on the amount spent per year).

In September you have spent a total of $1230 on goods and services. Depending on when you have signed up for the card, your billing cycle would start (a month between the dates). You receive a credit card bill on September 25 stating that your current balance that you need to pay back to the bank is $1230 and you need to pay it back by October 9, 2020. The bank will always give you time to pay your bill. You will have two options: if you cannot pay back the total amount owing, you could pay a minimum balance (usually around $10 or 3%) and the rest of the balance would be transferred to the next month and the bank would be charging you interest on it; or (which is the best option) you could pay back the total of $1230 and continue using the card without any penalties.

Credit card interest rates are high.

Our previous topic was “How to open a bank account” and if you read it, you would know that when the bank pays you interest on your savings, in Canada it is usually up to 4% of the amount in the account.

When you borrow money from the bank on a credit card and do not pay your balance on time, the annual interest rate on the amount you owe would be between 19% and 29% compounded DAILY.

Let’s assume you fail to pay your credit card balance of $1230 to the bank on time and the annual interest rate for your credit card is 19% compounded daily. For 6 months you are not using your card to make any additional purchases, but only paying off your debt. At the end of 6 months you would have made average monthly payments of $216.5 and the interest amount that you would have paid on top of your existing $1230 would have been $69.05.

There are a number of online calculators available to help you calculate the potential interest amount on your balance if you end up having an overdue balance.

Important things to consider

Having only a limited number of credit cards from different financial institutions is recommended. One or two should be ideal. It is easier to keep track and organize payments.

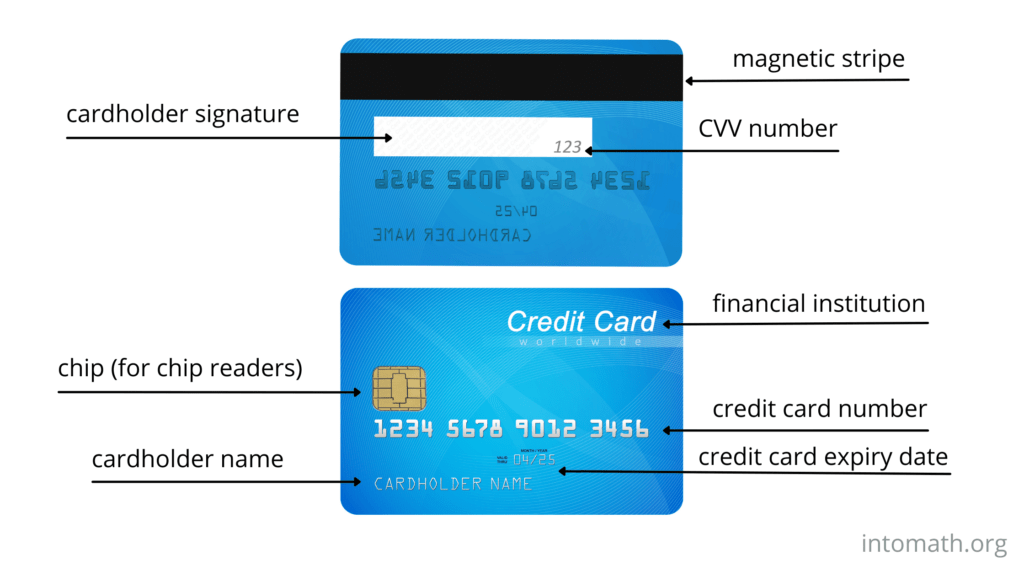

When you receive your monthly statement, it is always a good idea to check and verify transactions on the bill, to ensure there are no payments that have been made by someone other than you. Sounds impossible? Yes, it is possible! Credit card fraud is a very popular criminal activity these days and those who engage in it go a long way to obtain someone’s card information and use it to make purchases for themselves.

You can also use your credit card to withdraw cash. However, transaction fees would be rather high and you should only do this in emergency situations.

In general, credit cards are a convenient and simple method of payment. However, it is extremely important to understand how they work and organize your finances such that you do not end up having an monthly outstanding balance. Those who make their payments on time have an advantage of getting better rates on other products and services that the financial institution could be offering (like mortgage on a house or vehicle financing).